20 years of track record

Solutions for the financial industry

Direct Market Execution

FinIQ offers electronic liquidity for FX cash, FX derivatives, EQ derivatives and structured products via its own network and funds, bonds, shares execution via partner networks.

Investments & Securities

Investments & Securities Trading platform includes order and execution management, corporate action as well as investment accounting covering bonds, shares, IPOs, mutual funds, hedge funds, insurances, repo, structured deposits and MM.

Derivatives & Structures

Derivatives and Structured Products Trading platform helps in pricing, valuation, reverse enquiry, electronic dealing, order management, trade capture, documentation, life cycle analytics and payout of FX and equity linked products.

Electronic Foreign Exchange

Electronic Foreign Exchange Trading platform is used to automate mass distribution and dealing of spot, forward, swap, limit orders, NDF, precious metal products with a choice of using either single dealer or multi dealer liquidity.

Retail Wealth Management

Retail and Consumer Wealth Management platform includes client onboarding, product catalogue, order management, regulatory compliance, target portfolio, valuation and P/L statement.

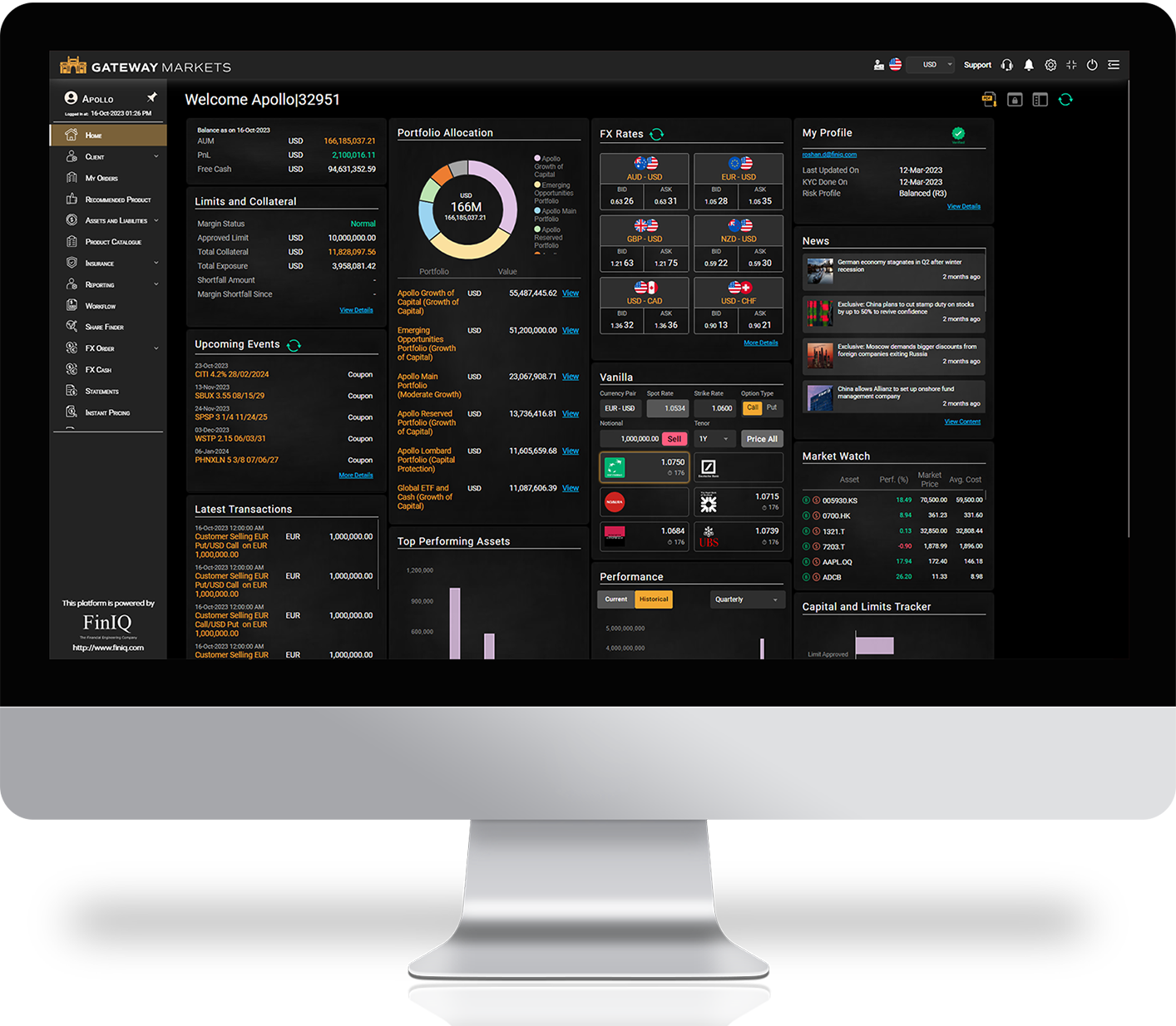

Private Wealth Management

Private Wealth Management platform includes multi asset class, multi issuer, multi dealer connectivity as well as wealth planning, click and trade dealing, documentation, post trade accounting, P/L statement and collateral management.

Structured products industry largely follows open architecture pricing, where products are priced from a panel of multiple liquidity providers, which may also include distributing bank's own capital markets desk. FinIQ automates a wide variety of structured product payoffs along with a choice of wrappers including notes, OTC, SI, ELI or SD. Powered by panel of 25 leading banks, it reduces the time taken for price discovery, order placement, execution, document exchange and post-trade MTM update. Besides achieving best execution, the operational risks are also greatly reduced, as over 95% of the communication between RMs and dealers, distributing party and liquidity provider is all done electronically. The system capability further includes API which can power direct-to-client trading apps.

FX Derivatives quotes are linked to real-time spot prices. In this case, the best execution on behalf of the client becomes very challenging, unless it is done via an electronic platform. FinIQ is a leader in multi-dealer FX derivatives automation, enabling banks to achieve an effective best execution by simultaneously sourcing quotes from a large panel of liquidity providing banks. The payoffs include vanilla, barrier, digital, strategies and structures including target redemption, pivot and accumulator forwards. The system further allows email notifications, booking of trades with accurate barrier and exercise fixing schedules, generation of termsheet, What-if analysis of the payoff, among many other features. The sales desk margin charged to client is priced by FinIQ spread calculation engine. Various pre-trade checks and suitability rules can also be configured to ensure safe user inputs.

Fixed income securities distribution involves multiple variations and the actual workflow differs from case to case. Client provided price quotes are largely indicative and the order execution is at the dealing desk's discretion. FinIQ catalog list thousands of bonds. User journey starts with use of FinIQ Workbench which comes with a smart search based on variety of filters, followed by pre-trade compliance and suitability checks. The spread calculation engine suggest the most appropriate spread which can be changed by the user. Order placed are either executed one by one or in aggregation. Execution can be electronically performed from various venues for FIX connections and APIs, or it can be manually marked. Contract notes, order status monitor, aggregate positions, IPO allocation, coupon calculations and entitlements, issuer and other limits and many such functions are also automated besides pricing and dealing.

FinIQ Equities Order Management functionality is suitable for both brokerage and wealth management businesses. The system allows direct execution of cash equities as well we other listed products such as ETF, futures and options, via leading venues. This is implemented using the industry standard protocols including the FIX protocol. Market data, news, corporate reports, announcements, historical charts and various such valuable contents is available via the same portal. Consolidated view of client portfolio, holdings, P/L, corporate action entitlements, cashflows, margin, trade history, order status helps both clients and their advisors in faster decision making. Orders can be placed one by one or in bulk. Besides the standard FinIQ WebApp, the entire functionality is exposed also via FinIQ's mobile apps as well as APIs which then can power the inhouse developed apps.

Mutual Funds or Unit Trust investments automation is based on subscription based workflow. FinIQ digitalises the process of client subscriptions via its native UI or UI built using FinIQ API. Various funds are listed in a user-friendly catalog with various searching and filtering options. Fund fact-sheet, historical NAV table and fees & charges are clearly laid out. The order taking process goes first through suitability and other pre-trade validations. The orders are then routed to the fund house via electronic API based links. Upon successful allocations, client holdings are updated and contract notes are generated. Various post-trade functions such as custodian reconciliation, redemptions, corporate actions, transfers, pledging as collateral, fund switch are also fully automated. Financing of funds can be using all cash or Lombard based financing. Monthly or periodic plans can be set standing instructions and system automatically generates the orders thereafter.

FinIQ eFX or Electronic Dealing module is suitable for both internally hedged trades as well as third party hedged trades. In the internal pricing model, FinIQ uses bank treasury desk sourced quotes blended with various margins. In the external pricing model, FinIQ FIX-protocol based multi-dealer liquidity links facilitate pricing and dealing helping the bank with true best execution. The spreading engine allows a combination of over ten different parameters to ascertain the most appropriate sales spread. Range of pre and post trade checks including credit limits and cash availability can be configured based on the business segment, user persona and much more. Post trade actions such as rollover, rollback, close out, cancel, amend, and take up as well as internal GL accounting entries and external SWIFT payments are also automated. Instruments supported include spot, forward, swap, forward-forward, NDF, NDS, precious metals, MM and limit orders. Mobile apps and also the APIs are provided. FinIQ also provides for trade finance and remittance workflow functionality from FX booking point of view.

Dual Currency Investments are extremely popular in the retail and private wealth segments. FinIQ automates sales pricing of these trades with various back solve targets. Volatility surface can be fed by the option desk or ready-made premium pricing can be sourced from FinIQ's FIX protocol based multi-dealer liquidity links. MM deposit component is separated by book independently with bank's treasury team, where the FX option component can either be retained inhouse or hedged externally. The system does indicative and final termsheet, email notification, mark to market, final fixing, exercise delivery and all the post-trade actions in an equally automated way. Traders can publish indicative pricing grids for reference. Rollovers can be done by simply clicking an expired or exercised trade. Ready to mobile apps are provided. APIs are also provided allowing the banks to build their own GUI.

Insurance policies tend to be very diverse. FinIQ UCP toolkit allows modelling of different investment products based insurance coverage and across multiple underwriters. The entire application process, verification, sending it to insurance company, receiving the feedback and issuing the policy is all done via a workflow which is entirely user configurable. Various add-on riders, policy surrender value, statement generation and much more is automated besides the main order workflow. All functionality is exposed via API and banks can build their own apps powered by these API.

Structured products issuance is a multi-phase, multi-party workflow. The wrappers can be note, swap, OTC and deposit format based. Banks often retain the funding component in-house and only hedge the derivative component with outside parties. Banks and distributors can also source the entire structured product package from outside. FinIQ helps sellside banks to help their distributors with such offerings. FinIQ accepts emails, FIX, API based requests for quotes and prices them via the internal pricing infrastructure at the sellside bank. Validations, order execution, document generation, ISIN update and final trade capture is also fully automated. All of this is done using a completely configurable framework of FinIQ called FinIQ UCP.

FinIQ's single issuer ePricer is a hosted WebApp that allows buyside distributors across multiple regions and multiple time zones with trading of structured products. This involves all major asset classes including equity, forex, rates and credit based payoffs. Pricing is instant further enhanced with various back-solve options. Orders can be executed on the same time. Limit orders can also be left for later time execution. The system comes with advisory support which includes popular underlings, trends of the day, news and commentary broadcast. Users can create their personalised portfolios and price them in bulk.

This module allows capture of trades done in various electronic platforms and also those that are manually dealt. The system captures economic parameters, event schedules, pricing & regulatory input, client orders and other details. Input process can be manual UI entry or trade upload or via API trade capture. The system maintains the trade from inception to redemption. It alerts various users on events respective to their functions. It records daily valuation in terms of mark to market and sensitivities. Documentation from the product manufacturer and documentation with the end client is all consolidated in one place. Various timestamp and user actions are audited. Accounting entries and payments can also be posted from this module.

Retail investments such as bonds, funds, insurance, deposits, notes, shares, and also the loans availed, if any to purchase these investments are booked using the FinIQ Retail Investment Booking module. This module acts as the central repository for various products. Even non-financial assets can also be booked. Such a central trade repository helps with client statements, holdings reports, volume report, reconciliation, issuer position, custodian position, concentration risk, post trade events and various other processes. Trade booking can happen from FinIQ's own order and execution platforms or from other systems. Inputs can be manual or via uploads or via APIs.

This module captures all FX & IR Derivatives trades in a central place. The trades may or may not be booked using the FinIQ order and execution modules. The centralization of all trade helps in various ways. It allows internal compliance and regulatory reporting easy. Management reports, counterparty concentration, middle office events, back office settlements and accounting becomes very convenient. Valuation including mark to market and sensitivities is captured on daily or even intra-day basis. Reconciliation with various upstream and downstream systems is done in a controlled way. All timestamps and audit trails are captured and reported. Even general ledger postings and payments can be generated from here. Margin calculations for various client positions can be computed including subsequent margin call workflows.

Custodian & Corporate Actions module handles various post-trade settlements including share delivery, cash delivery and corporate actions associated with shares, funds and bonds. If further automates all important reconciliation activities with the custodians. Incoming corporate action announcements, notifications to clients, client response collection and subsequent entitlement processing is done via a controlled workflow. Securities once bought or sold, on settlement date, the system orchestrates various events ensuring an error-free delivery along with the internal and external entries associated with it. The system also lists all past events and the client holdings and trades associated with each event. There is also a summary vs details analysis tool to match the sum of individual entitlements with the overall entitlement.

FinIQ's credit functionality is suitable for multiple business segments including private wealth, treasury, interbank and corporate businesses of various types of financial institutions. It contains both limit based and collateral based credit control. Under limits, it is transaction volume limits or daily settlement limits. Under collateral, it can financial assets such as deposits, bonds, funds, stocks or even non-financial assets. On the exposure side, it caters to various types of loan or loan-like facilities or even OTC derivatives based exposures including those for FX options, IR swaps and much more. The assets are pledged and unpledged via configured workflows. Margin calls and reminders are also workflow based. System allows the provision of pledging an entire portfolio with portfolio level loan-to-value ratio or individual level assets are given their specific LTV ratios. LTVs can be changed to suit specific situations. Initial margin, maintenance margin close-out margin levels are tracked for every combination of collateral and exposure.

FinIQ Structured products module takes care of lifecycle events for all commonly traded wrappers including notes, OTC and deposit or investment wrappers. The system models the lifecycle path of each trade using a configurable scripting language known as FinSPL, which can be altered by the end-users if necessary. New payoffs can also be defined using this language. Making use of the market data for closing and intra-day prices, the rule engine computes the state of coupons, redemptions and other cashflows. There can also be events that do not have any cashflow impact and they are needed to capture the interim change in the state of the product. Examples of this are, knock-in, accruals, corporate action impact, distances to barriers, mark to market valuation, memory checks and sensitivities. Interim results as well as final results are shown on an interactive dashboard with a range of user friendly filters. The users can be relationship managers, sales deals, structures, operations team or even the traders. FinIQ also connects electronically with the issuers and counterparties to source the actual life cycle results as evaluated by these parties in a formal calculation agent capacity.

FinIQ's documentation functionality is suitable for both manufacturers as well as the distributors. FinIQ Docgen is a toolkit that allows definition of document templates with data and condition tags, and produces Word, HTML, PDF, and even email based outputs. The system also processes incoming documents, enriches them with extra data and then forwards them. The entire orchestration is done using a workflow tool, which is built-in. The setup of tags, user roles, templates is all controlled by maker-checker and audit trail functionality. Events for document generation can be pre-trade or post-trade. It can be linked to quotes, orders, trades, settlements, corporate actions, margin calls, statements and much more. All documents generated are version marked and also saved in the database or any safe folder. Simulation tables, charts and graphs, special headers and footers, multi-lingual wordings, logos and many such non-text content can also be delivered via the FinIQ Docgen module.

FinIQ Portfolio management empowers investment advisors, portfolio managers and relationship managers with investment decision support. The end-to-end process first starts with the client onboarding, mandate details capture, risk profile assessment, product appropriateness check and then transitions into the portfolio proposal making process. A proposal can be constructed from a set of pre-configured target portfolios or it can also be a custom-made portfolio, which is tailored for a specific situation. One client may have multiple actual portfolios. Various trades, booked either using the FinIQ order management modules or booked via any other system flow into the FinIQ portfolio module. Holdings captured from such upstream order management source systems and also those via transfers and corporate actions settlements make the composition of the actual portfolio. The client portfolio is periodically compared with the target portfolio resulting in rebalancing recommendations. These recommendations are then routed to various trading venues using either FinIQ order management modules or any other platform. P/L, risk ratios, cashflow, positions, concentration and various such measures are regularly computed using the latest market data. Results are accessible using an interactive dashboard, client statements as well as using standard and customized reports.

FinIQ pricing library is a collection of mathematical formulae and algorithms, which are exposed in the form of standard APIs. The coverage includes pricing and risk calculation support for both linear and non-linear instruments. These pricers allow instant reference pricing for relationship managers, which then can be used for actual trade booking or only for indicative pricing purpose. The raw market data includes FX spot and swap rates, MM rate, IRS rates, volatility surface, bond prices, correlation, equity prices, etc. This data can be sourced in real-time or it can be periodically uploaded. Trading desk or middle office may also hand-input the data if necessary. The models can be closed-formed equations such as Black-Scholes and Vanna-Volga, or they can be simulation based models such as Local and/or Stochastic Volatility models. The yield curve and volatility surface construction is done using a mix of instruments and with a choice of interpolation method. Back-solve functionality comes built in which allows client target premium or upfront commission as the input to solve various strike or barrier levels. The system also computes Greeks including delta, vega, gamma, and others. Schedule generation is based on market norms and based on published holiday calendars. The system also offers pre-trade what-if, mid-life what-if, stress test, back-test and multiple such risk assessment tools. As FinIQ derivatives payoffs are not hard-coded, and hence all this functionality is applicable to any instrument or payoff which is constructed using the FinIQ UCP (User Configured Products) module and modelled using the FinIQ FinSPL (FinIQ scripting language).

FinIQ Client Advisory module is client-centric functionality, unlike the most other FinIQ modules which are mainly product-centric. Here the client's status, profile, identity, declaration, contact, KYC, correspondence as well as the investment holdings, RFQs, orders, trades, income, returns, fees, documentation and corporate action announcements are all accessible in one place. It further comes with drill-downs, which can take the user to various product functions. The client relationship here is measured in terms of volume, sales commission, number of trades, hit ratio, AUM pledged, actual AUM, etc. which improves the decision making ability of the sales team. Client's cash balances, collateral availability, purchasing power is also available in the same module. The system access can be given directly to the client, but with a limited visibility. Recommendations, proposals, market analysis, tips, alerts, news, charts, reports and various such non-trading content can be delivered from here. Clients accessing this module can be diverse. It can be retail clients, private wealth clients or even external asset managers or financial institutions. Each segment can have their own look and feel and user access profile.